The Texas Last Will and Testament is a legal document that reflects the final wishes of a testator with regard to their estate and how they would wish that estate to be distributed to its beneficiaries. This document would be created not only for the purpose of continuing to provide for their immediate and extended family members but also friends and institutions that may be of importance to them. The property listed in this document is generally distributed by a trusted executor. Distributions may be those of personal property, real estate, fiduciary or digital assets among others. As the testator completes his decisions, the document must be signed by two witnesses and all signatures will require notarization. The document, as long as the testator is of sound mind, may change or revoke this document at their discretion at any time.

Definitions – Estates Code, Subtitle F.

Laws – Estates Code

Signing (Sec. 251.051) – Must be attested by the Testator and by Two (2) or more credible Witnesses who are at least 14 years of age and who subscribe their names to the will in their own handwriting in the Testator’s presence.

Step 1 – Establish a testator of this document by placing their full name at the top of the document, to be followed by:

These forms were originally published in Mr. Stevenson’s Texas legal form books for lawyers. These forms have been used and trusted by Texas Attorneys since 1982 & are Used in Texas County Law Libraries and Texas Law Schools.

- The testator’s name

- City and County

- Reviewing the remainder of the paragraph

- Read “Expenses and Taxes”

Step 2 – Appointment of a selected Executor – Enter:

- The Name the testator’s chosen executor

- Name the City and County of the executor

- Executor’s State of residence

For the protection of the estate and beneficiaries, it would be wise for the testator to select an alternate executor in the event the initial representative is unable to carry out the execution of the estate according to the wishes of the testator. Select an alternate representative and enter:

- The name of the alternate executor

- City of residence

- County of residence

- Alternate’s State of residence

Step 3 – Disposition of Property – Beneficiaries

Beneficiaries – Enter the following information:

- Their legal name

- A physical addresses for named beneficiaries

- Provide a description of the relationship to the testator

- Enter the last four digits of the SSN for all persons named beneficiaries

- Enter a list/descriptions of property that the testator shall provide per beneficiary

Step 4 – Testator should review all titled sections:

- Omission

- Bond

- Discretionary Powers of Personal Representative

- Contesting Beneficiary

- Guardian Ad Litem Not Required

- Gender

- Assignment

- Governing Law

- Binding Arrangement

Step 5 – Witnesses/Signatures – All who shall serve as a signatory will be present to one another at the time of the signing of the document. All must enter:

- The name of their testator

- Date of testator’s signature

- Testator’s individual signature

- Testator’s printed name

Witnesses – Witnesses should review the brief statement and enter:

Texas Legal Forms free download. software

- Date of the signatures

- Name of the testator

Witness 1 –

- Signature

- Physical Address

Witness 2 –

- Signature

- Physical Address

Step 6 – Affidavit of Testament – All signatories must review, then enter:

- State

- County

- Name of testator

- Name – 1st witness

- Name – 2nd witness

- AND

- Signature of testator

- Signature – 1st Witness

- Signature – 2nd Witness

Step 7 – Notary- As the testator completes the document, any signature shall be witnessed and acknowledge by a commissioned notary.

Texas Power of Attorney Forms allows one person to grant another party the right to make decisions and act on his or her behalf. The person doing the appointing is called the “principal” and the person he or she appoints is called the “agent” or “attorney-in-fact.” There are many types of powers of attorney each geared to the issuer’s needs. Some powers of attorney allow you to confer all of your financial power to another, while others are for more limited situations, such obtaining title to a vehicle. In all cases, you should think about who you want to act as your agent because they will have a lot of responsibility over your affairs.

Laws – Title 2, Chapter 751 (Durable Powers of Attorney)

Durable (Financial) Power of Attorney – This is a type that confers broad financial powers on your chosen representative. It will also continue to be in effect if you become incapacitated unless you revoke it before.

- Download: Adobe PDF, Microsoft Word (.docx), Open Document Text (.odt)

- Signing Requirement (§ 751.0021): Notary Public

General (Financial) Power of Attorney – This is also a type that allows you to confer broad financial powers, however, unlike the durable form, it terminates automatically if you become incapacitated.

- Download: Adobe PDF

- Signing Requirement (§ 751.0021): Notary Public

Limited Power of Attorney – This form of POA is less broad and can be tailored to meet your specific need to appoint a representative for a limited transaction.

- Download: Adobe PDF, Microsoft Word (.docx), Open Document Text (.odt)

- Signing Requirement (§ 751.0021): Notary Public

Texas Legal Aid Forms

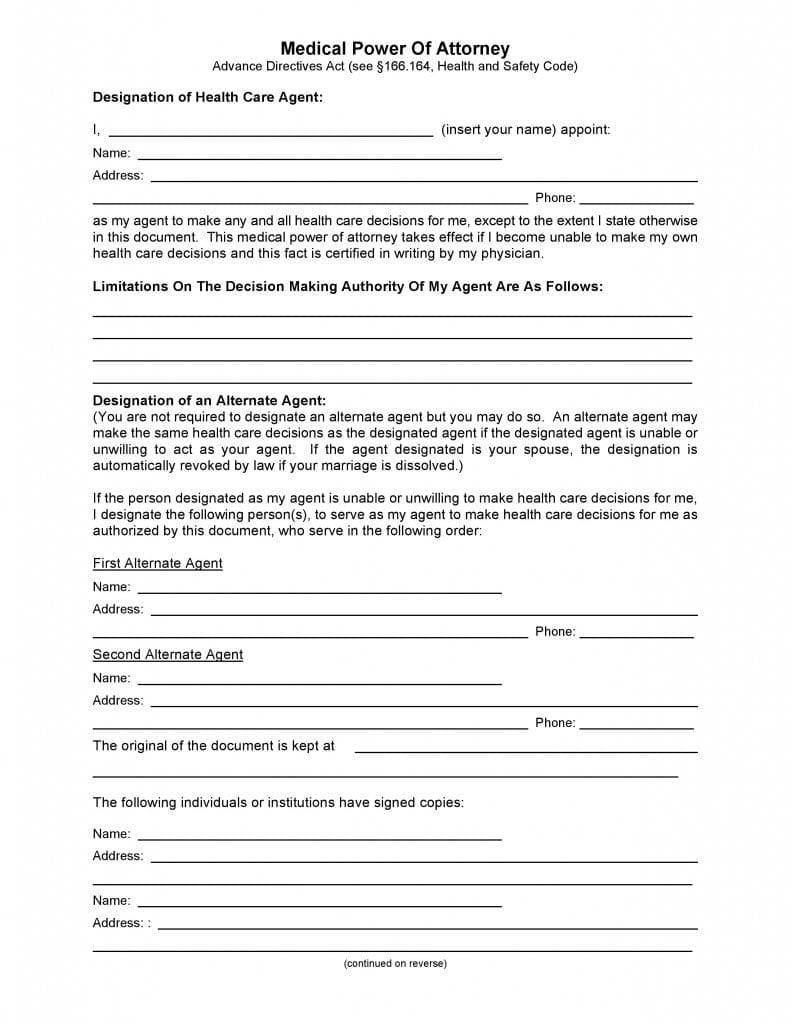

Medical (Health Care) Power of Attorney – This form gives you the ability to designate a loved one to handle your health care issues and decisions in the event you can no longer communicate your wishes.

- Download: Adobe PDF

- Signing Requirement (§ 166.154): Notary Public or Two (2) Adult Witnesses

Guardian of Minor Power of Attorney – For the use of a parent who would like to delegate the care of their son or daughter in the care of someone else. If the parent would only like to select someone else, in the chance they become incapacitated, they should fill-in the Designation of Guardian for Incapacitation.

- Download: Adobe PDF, Microsoft Word (.docx), Open Document Text (.odt)

- Signing Requirement: If only one (1) parent is able to sign, the power of attorney must be witnessed by two (2) subscribing witnesses. It is suggested that the document be notarized.

Real Estate Power of Attorney – Choose an agent to negotiate and handle the transaction of real property. This form may also be used to choose someone to make decisions on the repairs, leasing, and evictions of the premises.

- Download: Adobe PDF, Microsoft Word (.docx), Open Document Text (.odt)

- Signing Requirement (§ 751.0021): Notary Public

Texas Legal Forms Free Download Sites

Revocation of Power of Attorney – This form is used when you have an existing POA that you wish to terminate. Make sure that your agents have a copy of this signed form so that there is no question that they are no longer to act under the original POA.

- Download: Adobe PDF, Microsoft Word (.docx), Open Document Text (.odt)

- Signing Requirement: No statutory requirement. However, it is suggested that the document is notarized.

Tax Power of Attorney (Form 86-113) – This form is for use when you wish to designate a tax professional to handle your tax matters.

- Download: Adobe PDF

- Signing Requirement: Agent

Free Texas Legal Forms Downloads

Vehicle Power of Attorney (Form VTR-271) – This form is for use when you wish to designate someone to handle your vehicle issues with the Texas Department of Motor Vehicles.

Texas Legal Forms Free Download Free

- Download: Adobe PDF

- Signing Requirement: No Additional Signatures Required